Acquisitions are complex, which is why they fail more often than not. Pre-acquisition due diligence is only half of the battle; the other half is the hands-on, strategic integration of the acquired company. As this report from the Harvard Business Review puts it, “the success or failure of an acquisition lies in the nuts and bolts of integration.”

“Every day, the wrong companies are purchased for the wrong purpose, and the wrong elements are integrated in the wrong business model.”

With these integration challenges in mind, Valitas circled up with Todd Blair, founder & managing partner of GrowthPoint, to discuss post-acquisition areas of focus for companies aiming to achieve their growth goals. In Mr. Blair’s experience, integration success hinges on a company’s ability to address the following four factors:

1. Products and Services Strategy

“Product Rationalization 101,” as Mr. Blair calls it, and a lot of this strategy work should be done during the due diligence phase. The following questions should be answered when combining the two companies’ product portfolios:

• Are we going to bundle products? if yes, how are we going to bundle and how does this affect value proposition and pricing strategy?

• Which products aren’t working? Should we cut them or is there an opportunity to rebrand them?

• How can we optimize our go-to-market strategy to best accommodate our new product offering?

Of the four factors in this list, product strategy is most central to the ultimate success of the acquisition. The effects of a well-integrated product strategy are seen in both top-line and bottom-line performance. A study from A.T. Kearney suggests that well-integrated product portfolios reduce COGS and SG&A expenses by as much as 30%, attributing the benefits to better utilization of resources and a more efficient salesforce. The same study suggests that the three main reasons for failed product integrations are:

i. Failure to address product strategy during the due diligence phase;

ii. Managers afraid to make decisions related to product strategy, resulting in an overly complex amalgamation of underperforming products; and

iii. Management lacking incentive to tackle product portfolio complexity early in the M&A process.

2. Sales and Channel Execution

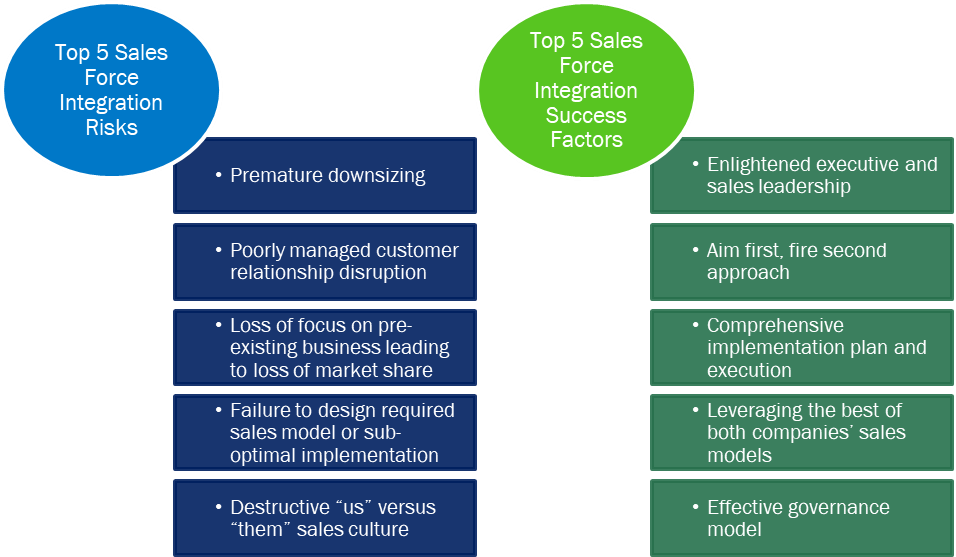

A well-defined post-acquisition sales integration strategy can be the difference between impressive top-line growth and deterioration of existing revenue streams. Strategic considerations here range from structuring the combined sales organization to adjusting compensation plans to refining sales and marketing strategies. Deriving insights from over 200 sales force integrations, U.S.-based management and sales consulting firm ZS Associates highlights the importance of a smooth sales force integration during an M&A process and identifies the following sales force integration risks and success factors that can either undermine or propel the success of a merger.

Figure 1: Impactful Sales Force Integration Factors

3. Brand Strategy

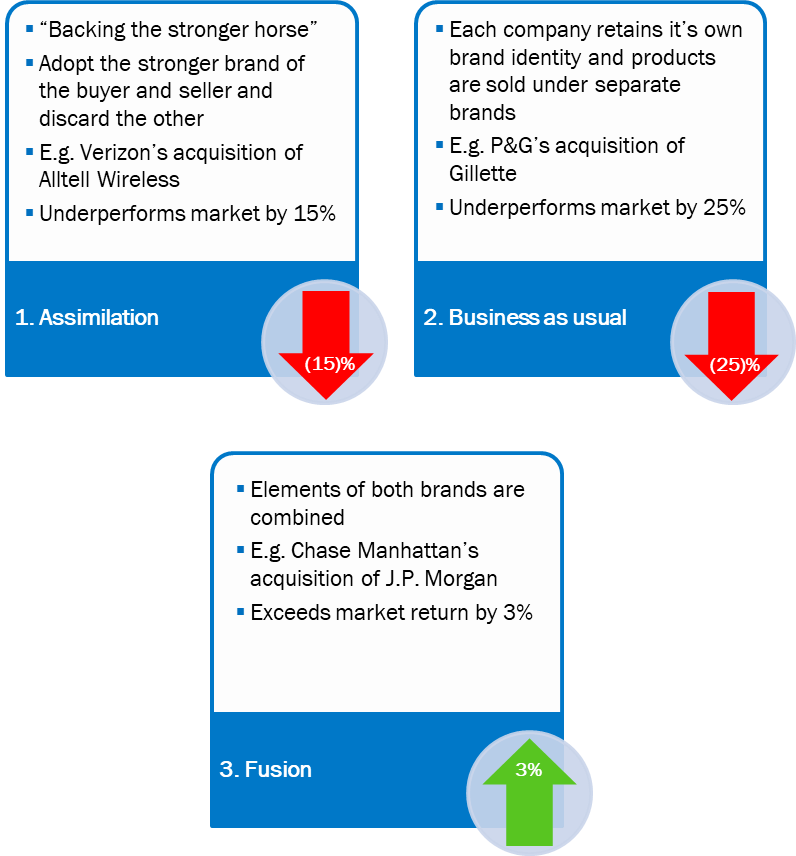

Brand strategy is crucial. It’s not tangible in the way a combined company’s product offering is, but it’s contribution to the success of an acquisition is of equal importance. A clearly defined brand strategy paves the way for a cohesive workforce, efficient sales and marketing tactics, and, most importantly, an engaged customer base. A study from Type 2 Consulting analyzed the post-acquisition brand strategies of over 200 companies formed through acquisitions. The post-M&A brand strategy playbook contains 3 options: assimilation, business as usual and fusion. Figure 2 outlines these options and showcases the average 3-year post-acquisition performance relative to the overall market for companies deploying these respective strategies.

Figure 2: Post-Acquisition Brand Integration Strategies

Of the three options, acquiring companies that fuse components of each company’s brand to create a combined brand strategy have experienced growth 3% greater than the market. Acquiring companies that choose to adopt more passive brand strategies, meanwhile, has historically underperformed the market by a wide margin, emphasizing the importance of investing resources into a refined brand strategy following an acquisition.

4. Customer Experience

The preceding three factors all tie into customer experience, which as Mr. Blair puts it, “is a company’s ability to delight its customers every step of the way.” While not usually a deal breaker, an acquiring company’s approach to customer experience can certainly impact the degree of success in a deal. Best practice in a deal is to adopt the model of the company demonstrating superior customer experience, which can be as simple as documenting processes and training employees to bring them up to speed. “Addressing customer experience sounds simple, and it is,” says Mr. Blair, “but ignoring it can cause tremendous problems.”

Take, for example, a B2C business (Company A) with a mediocre customer experience standard. In an effort to break into the e-commerce space, Company A acquires Company B—a similar, but smaller, B2C business with a highly profitable partnership with Amazon and a great standard for customer service, including 24-hour phone support and chat room availability. Company A values the deal based on the revenue growth it expects to realize through Company B’s Amazon partnership.

After the deal closes and Company A integrates Company B’s operations into it’s own, Company A dismisses 24-hour phone support and chat availability as unnecessary. Over the next couple of months, Company A begins to receive complaints from Amazon customers about their inadequate level of support and eventually their service level drops below Amazon’s minimal acceptable threshold, causing Amazon to temporarily shut down the partnership. It takes three months for Company A to re-establish this partnership and, in that time, the company has missed out on a significant piece of revenue that it had factored into its acquisition price of Company B. The result is that Company A’s management falls short of their acquisition growth target and are left to explain themselves to disgruntled shareholders.

Conclusion

The moral of the story? Successful acquisitions are underpinned by rigorous strategic planning and execution. In a global marketplace fraught with M&A deals born in overly ambitious growth expectations, business owners who focus on the above four factors will position themselves to defy the odds and become one of the success stories that account for less than 30% of M&A transactions.

This article has tackled the Xs and Os of integration to ensure healthy post-acquisition growth, but what about the impact of combining cultures? Take AOL and Time Warner for instance, counterparts in a record-setting $350 billion merger in 2000 who subsequently fell victim to a catastrophic culture clash that eroded over $200 billion in shareholder value. How’s that for impactful? Stay tuned for an article on culture’s contribution to M&A success.