Imagine you’re getting married. The date is set, all the arrangements have been made, and you are scheduled to leave for a two week honeymoon in Paris the week following the nuptials. You have given your clients notice of your plans, and matters that require your attention have been scheduled around your trip. Then a freak weather event grounds all air traffic and the guests can’t make it to the wedding. Do you delay by a few days and shorten your trip? Or do you simply push everything back a few days? But then what about the client meeting scheduled for the Monday you get back?

Multiply that complexity by 10 (to include the key executives, attorneys, and advisors on both sides of the transaction) and that’s what it’s like to miss a closing deadline. It’s not the end of the world, but it creates all manner of unforeseen challenges that can ruin the honeymoon.

Successful Deals Follow the Script

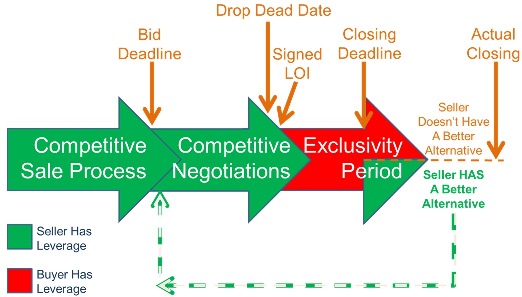

Although every deal is unique and some transactions take longer to close than others, every deal that ends well follows a fairly predictable script. The key to success is for the seller to maintain the leverage in negotiations throughout the process. The more competitive the process, the greater the seller’s leverage, because the seller has multiple offers to choose from. If, however, the seller has limited options, or there is a significant difference between the best offer and the runner up, then the seller’s advisor can create leverage by keeping the exclusivity period prior to closing as short as possible, and then working carefully to keep the process on track. Below are the most common milestones and deadlines in a sale process:

- The owner or CEO makes a decision to sell the business and hires a qualified investment banking firm;

- The investment banker formulates a target list of prospective buyers and sets a soft deadline for prospective buyers to make their initial offer (“The Bid Deadline”);

- Working backward from the Bid Deadline, the investment banker reaches out to buyers in a concerted manner so as to give each buyer enough time to review the opportunity and prepare an offer by the Bid Deadline, but not all buyers are given the same amount of time;

- Buyers are contacted, and if they express interest in acquiring the business, they sign a confidentiality agreement;

- Once all of the buyers have been contacted, the investment banker evaluates the field and sets a firm Bid Deadline; and,

- When a buyer makes an offer, the offer will typically have a time limit (as the buyer wants to set a deadline for acceptance) often called the “Drop Dead Date”.

Deadlines Create Competition

Between the Bid Deadline and the Drop Dead Date, a qualified investment banker will negotiate with multiple buyers to get the preferred buyer to make the preferred offer — an offer that is not only the highest price, but also offers other advantages such as the form of consideration (all cash is typically preferred) and the time frame required for due diligence and closing.

Setting and sticking to deadlines will keep your deal on track. As seen in the graphic, if the buyer fails to close by the closing deadline, the seller has three options:

- Provide the buyer with an extension (not preferred) and close late. If the seller has a back-up buyer, it may be time to extract a good faith deposit or a break-up fee from the buyer;

- Walk away from the deal and re-engage with the back-up buyer; or,

- If there is no good alternative, walk away with no deal at all.

Why Not Treat All Buyers the Same?

Because not all buyers are the same. Let’s say your business makes high quality components for a major U.S. automaker. The buyer who knows your business best is likely a competitor that also sells to that same automaker and knows the advantages and disadvantages of the products and services you offer. Perhaps another component manufacturer in Europe sells similar products, but to Italian automakers. The former knows your business, your products, and your customers and won’t take long to formulate an offer. The latter knows your products, but there may be a language barrier, and they need time to better understand your market, pricing, and the customers you serve.

Another consideration is the transaction experience of the buyer. If the buyer has never completed an acquisition, the due diligence and negotiations can drag on and on. We recommend in these situations to negotiate a highly detailed letter of intent, or even a first draft of the definitive agreement prior to entering the exclusivity period, in order to avoid losing control of the process. In contrast, a highly acquisitive buyer (such as a private equity firm) can be expected to complete their due diligence quickly (they often use outside professionals), and turn around a draft of key documents quickly.

Establishing a Firm Bid Deadline

Missing a deadline always signals something about the seller or the competitive nature of the process.

If the seller lets a deadline pass without consequence, this may signal to the buyer that there is no competition, whereas a seller who makes it clear they will not tolerate a missed deadline signals that there are many buyers at the table and there is relatively little differentiation between the high bidder and the runner up.

If the buyer misses a bid deadline, it could signal that they don’t feel their offer would be competitive, it may signal that they are unsure about the opportunity, or they don’t think there is really much competition.

Every deal follows more or less the same process between a signed letter of intent and a closing. It’s wise to schedule these out as milestones, each with a time limit. That way, if the buyer is failing to meet the agreed-upon time frame, the seller can walk away. Even if you don’t intend to walk, this gives you leverage, and keeps the buyer honest.

What Are the Implications of Missing the Closing Deadline?

As in the wedding example above, getting left at the altar can have many negative consequences; some catastrophic, some less so.

On a recent deal, the seller was not able to complete the asset schedules in time for a closing, and the closing had to be delayed. Key executives for the buyer were traveling in the days that followed, which delayed the closing still further. The lack of urgency was distressing to the seller, who began to lose confidence and caved on a number of final negotiating points to get the deal across the finish line. The deal closed at the agreed-upon price eight days later, but some of those “minor details” could potentially come back to haunt the seller.

On another deal, I had a client accept a $20 million offer from a large publicly-traded engineering firm. The due diligence was completed by Labor Day, and the original closing was scheduled for September 15th, 2008, but one of the senior members of the team was to be on vacation in Europe. The seller decided to wait until she returned at the end of the month. On the would-be closing date, Lehman Brothers filed for bankruptcy, setting off a financial crisis which caused the stock market to drop precipitously — including the buyer’s own stock. which declined by 20% between September 15th and September 26th. The buyer wanted to renegotiate the price, but the seller was unwilling to do so, and the deal never closed.