Susan Thompson decided it was time to sell her company. She’d started out thirty years before as a one-person shop, and through sweat and perseverance, had built the business to $20 million in revenue, with a healthy EBITDA of $5 million. Being of a certain age, Susan had entrepreneur friends who had gone through a business sale. Some hired M&A advisors to facilitate, and others didn’t. Those who hired advisors seemed to have an easier time getting through the process, including selling at a price they were happy with .

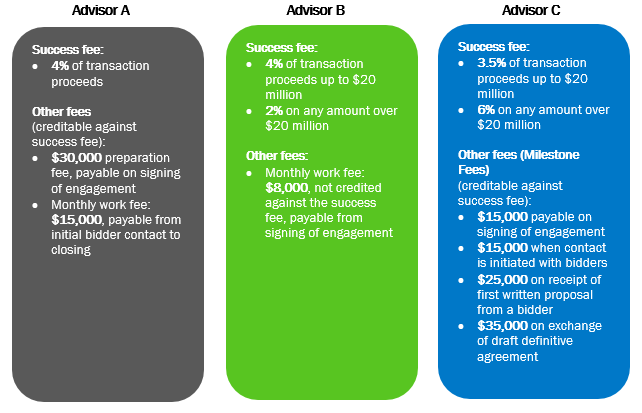

Through referrals from friends and colleagues, Susan compiled a short list of three boutique M&A firms. She met with each, and was pitched on the virtues and fee expectations of the respective teams. She was surprised to find that each firm suggested a different fee structure.

All three of the advisors came with stellar referrals, and all seemed to have teams she could work with. Susan needed to think about which fee structure made the most sense for her.

It is often difficult for private sellers like Susan to obtain information on M&A advisory fees. Fortunately, in 2016, Divestopedia and Firmex reported on the results of an inaugural survey that shed light on this topic, and their 2017 report has recently been released. The report concludes that, consistent with Susan’s experience, there isn’t one single industry standard, and that fees vary by structure, size and terms. To gain additional perspective on this topic, we spoke to John Carvalho, President of Divestopedia, who shared some of his insights.

1. Success Fee Structure

Typically, three dominant methodologies are used by M&A advisors to structure fees. The simple percentage structure, as the name implies, charges a fixed percentage based on the total transaction value (See Advisor A example). Ease-of-use is the main reason behind its prevalence.

Nevertheless, industry practitioners have developed more advanced ways to structure success fees. Two other widely-used mechanisms adopt a tiered structure. Variations on the Lehman formula, legacy of the then-global financial service firm Lehman Brothers, employ a descending scale which dictates decreasing marginal fees as total transaction value goes up . It was originally designed for capital raises and later became more broadly applied. (See Advisor B example/)

However, the Lehman methodology does not always incentivize advisors to pursue the best results for their clients, since their additional efforts to achieve a higher transaction value do not lead to proportionally higher monetary rewards.

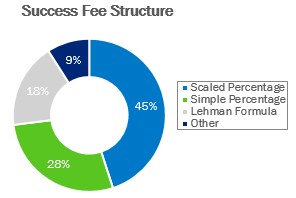

Scaled percentage, on the other hand, moves in the opposite direction to the Lehman formula. Specifically, as total transaction value increases, on the margin a higher percentage of success fee is applied. (See Advisor C example) This approach is becoming increasingly popular (see chart below) since it benefits both advisors and business owners alike if a higher transaction value is achieved.

Is there a single fee structure that is always ideal under all cases? According to Mr. Carvalho, the universally applicable, ideal fee structure does not exist. The fee structure needs to “meet the objectives of the client [and] correspond with the facts of a transaction.”

2.Success Fee Percentage

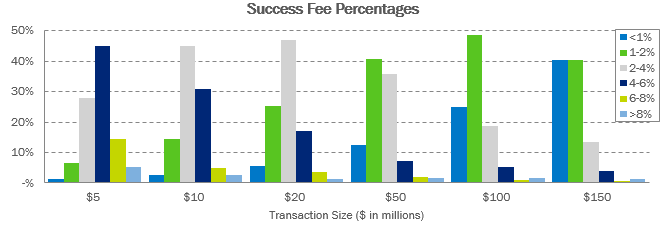

Knowing how fees are typically structured, what percentage should Susan expect to pay her advisor? According to the Firmex/Divestopedia report, as overall size of the deal goes up, the average fee percentage declines.

Consequently, the fee percentages in Susan’s proposals may vary from those reported by her business owner friends, due to size differences in their respective businesses. Additionally, as illustrated in the chart below, even within the same deal size bracket, there is variability in success fee percentage.

Do higher fees always correlate with better services? The answer is not binary. Some industry professionals do charge above-market success fees in exchange for a premium service offering, but transaction size as well as geographic factors also come into play here.

“There are three primary reasons behind the fee variability,” says Mr. Carvalho. “The proliferation of boutique firms, regional differences and a lack of transparency.” He recommends that, rather than simply selecting the lowest priced advisor, it is critical for sellers like Susan to do rigorous due diligence when making this important decision. This includes reference checks with previous clients, asking about the advisor’s track record with prior transactions and conducting desktop research on multiple advisors.

3.Other Qualitative Considerations

There are a series of other considerations when assessing M&A fees. First, most advisors charge a monthly or hourly work fee for time spent performing their service. These non-refundable work fees can be credited against the final success fee, although this is not always the case.

Second, the timing of success fee payment can also vary. Different types of consideration may be included in the sale price, and part of the sale price, such as amounts payable under an earnout provision, may be only be due after the transaction closes and can be subject to terms and conditions.

It is worth noting that advisors often require that success fees be paid in full at closing, regardless of when, or if, the full value of the purchase price will be received by the client.

Third, success fees typically have tail periods that extend well past termination of the engagement. A fee tail period dictates that if a transaction is closed within a predetermined period after termination of the engagement, the advisor is still entitled to full payment of the original success fees.

Mr. Carvalho advises that, in negotiating an engagement letter, private sellers should remember that “nothing is off the table. All of the terms of an engagement letter are negotiable.” Becoming knowledgeable about these qualitative factors puts the business owner in a stronger position to negotiate favourable terms with an M&A advisor.

Susan’s Decision…

After considering her options, and weighing John Carvalho’s advice, Susan opted for Advisor C. She wanted a fee structure that aligned the advisor’s interests with her own. As Advisor C would receive a lower percentage for an average price and a premium for a higher sale price, there was strong incentive for the advisor to achieve a higher price for her business.

Susan also felt that the milestone fee model provided incentive for the advisor to move the sale process along, which is exactly what she wanted. Finally, before she signed the final engagement letter, Susan stipulated that any consideration from an earnout provision would only be paid when she received it. And with the acceptance of her terms, the engagement letter was signed, and Susan’s business sale process was launched.