Working on the buy-side means that I not only get to negotiate a deal, but that I also have to put together a realistic financing structure that will get that deal done. That isn’t always true for sellers. In fact, in many cases, the sellers of a business (and even their intermediaries) will have no idea how the buyer has financed the acquisition.

As a public service to business owners that are thinking of selling, I thought it would be interesting to provide summaries of the actual “sources and uses” on our past completed buy-side engagements. To maintain my clients’ confidentiality, I have used percentages of the total deal price rather than the actual values. For background and relevance, the following three transactions had enterprise values between $20 million and $50 million, were in the industrial services industry, and were located in the region in which my firm operates. Each transaction was completed by a strategic acquirer.

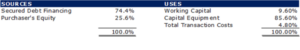

Deal No.1

The implied valuation multiple (TTM EV/EBITDA) was 3.9x. There was no goodwill inherent in the transaction because the appraised fair market value of the capital equipment was equal to the purchase price. That was a big reason I liked this deal. In the worst-case scenario, if the business did not perform well post-acquisition, the buyer could consider selling off assets to pay down outstanding debt. Also, with a significant amount of capital equipment, it was easier to obtain secured debt financing for the buyer.

Lessons That Sellers Can Learn From This Deal

Do you have to “right size” your asset base before selling? In this situation, the owner might have been able to sell some assets prior to the sale and pocket the cash without impacting the earning potential of the business. Of course to do this, you need to prove to potential buyers that the assets are redundant and not needed for future operations.

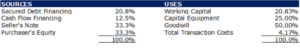

Deal No.2

The TTM EV/EBITDA was 3.4x in this deal. In contrast to Deal No.1, there was a significant amount of goodwill inherent in this transaction; probably more than I am comfortable with. In hindsight, I would have negotiated a higher amount of working capital to be included in the enterprise value. I can talk a big game now, but at the time, this may not have gotten the deal across the finish line. Cash flow financing (subordinated debt) was obtained for this deal because a limited amount of hard assets could be placed as security for senior debt financing. Also, a seller’s note was negotiated to bridge the financing gap created by the higher amount of goodwill, which is extremely difficult to finance.

Lessons That Sellers Can Learn From This Deal

Goodwill is scary for buyers. Companies that do not have significant net tangible assets should try to qualitatively and quantitatively justify the value of goodwill implied in the business. This can be done by finding ways to put a value on customer/supplier relationships, brand name, patents and trademarks. Also, if there is a significant amount of goodwill, be prepared to consider sellers’ financing, because lenders have difficulty providing capital for its purchase.

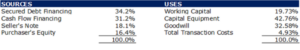

Deal No.3

The TTM EV/EBITDA multiple on Deal No. 3 was 3.0x. The financing structure was a little more aggressive with only 16.4% of the total purchase price coming from the purchaser. This was due to the purchaser’s successful track record of acquiring and operating businesses. It was also due to the acquired business’ historically strong cash flows.

Lessons That Sellers Can Learn From This Deal

Sellers are often hesitant to provide financing to close the sale of their own business. A vendor must remember that banks like to see a certain level of seller’s financing in a deal because it ties the selling owner to the business and ensures (to some extent) that they are committed to a successful transition. It also provides confidence to lenders that the seller believes in the future prospects of the business. Exiting business owners must also get comfortable with the abilities of the new acquirer to continue to profitably operate the business and pay off the seller’s financing.

Overriding Lessons to Be Learned

There is a strong correlation between the amount of goodwill present and the seller’s financing required to acquire a business. In other words, if your company has more goodwill, expect to be asked to provide more seller’s financing.

The above summary of sources and uses exemplify the exact definition of leveraged buyouts. Although these are aggressive financing structures, they represent close to the maximum amounts of secured and subordinated debt financing that can be obtained based on required banking covenants, the levels of asset backing and cash flow within each business. The only way to increase the purchase price is to convince the buyer to put in more equity or provide more seller’s financing.

Total transaction fees (legal and advisor costs) for the buyer ranged between 4-5% of total purchase price. The take away is that completing a deal costs money on both sides. Buyers and sellers should avoid the DIY approach. In my experience, the saying “being cheap can be very expensive,” is especially true when it comes to selling or buying a business.

Transaction multiples for these three businesses were in the range of 3.5x – 4.5x TTM EV/EBITDA. Of course, market conditions, industry or region might dictate something different.

If a company’s risk profiles really does not change when the market heats up or cools down. So why should the multiple, which is a barometer of the riskiness of a business’ ability to generate future cash flows, change significantly when the market changes? Vendors will see an uptick in business valuations in good times because a TTM EBITDA multiple applied to a higher TTM EBITDA will result in a higher overall valuation. Also, deal structures might be more favorable to sellers when financing institutions lend capital more liberally. Therefore, acquirers might ask for less sellers’ financing to close deals. But, in general, an industry multiple of TTM EBITDA is my starting point for determining the enterprise value of a business.