A recently published Fairfield University whitepaper is the first comprehensive study quantifying the value of the services provided by an investment bank during the sales process, as determined by a survey of business owners who sold their business during the last five years. (Download the whitepaper here.)

This study answers two key questions:

-

Do business owners believe that their investment bankers added value in the process?

-

Of the services provided by investment bankers, which ones did business owners value the most?

Prior to this study, there was only anecdotal evidence of investment bankers’ value, which was typically provided by the investment banks themselves as they were pitching for new business. There were no hard figures or supporting data to validate the value created by middle market investment bankers, until now.

Methodology

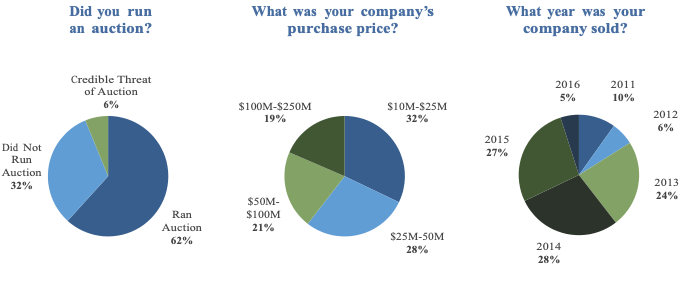

During the first half of 2016, surveys were obtained from 85 owners of privately held, middle market companies who sold their business for between $10 million and $250 million using a reputable investment bank. Twenty four investment banks asked former clients to fill out surveys anonymously online, which were tabulated by Critical Mix, a global marketing research firm. The statistical analysis was performed by Assistant Professor Michael McDonald of Fairfield University’s Dolan School of Business.

To qualify for this survey, respondents had to meet all of the criteria below:

- Private, owner-operated company.

- Valued between $10 million and $250 million.

- Company headquartered in the U.S.

- Majority of the equity was sold.

- Transaction closed between 2011 and 2016.

- Company was represented by a quality investment banking firm.

The survey included a broad sampling of qualified respondents as outlined below:

Questions of Business Owners

Owners were asked to rank each of the following services provided by their investment bank:

- Finding the buyer

- Negotiating the deal

- Managing the sales process

- Adding credibility to the seller

- Preparing the company for sale

- Educating and coaching the owner

- Structuring the transaction

- Enabling owners to run the business

For clarification, below are descriptions of each service:

Finding the buyer

Investment bankers supplement the owners’ knowledge of their markets and potential partners by tapping into their professional contacts and networks, investor databases, and expertise to identify and connect with interested buyers.

Negotiating the deal

Investment bankers typically take the lead in negotiating the terms — not only purchase price but also the terms and conditions, timing, process and other major considerations of the transaction.

Managing the sales process

Investment bankers are often “quarterbacks” for the entire transaction process. They are the ones who are responsible for keeping the transaction process competitive, coordinating between all of the different aspects of the transaction, managing a broad team of other advisors and keeping the transaction moving to a closing.

Adding credibility to the seller

Engaging a quality investment bank illustrates to all of the parties involved that there is a genuine commitment to explore the transaction and that there is professional representation, thus increasing the likelihood of a successful closing.

Preparing the company for sale

Sellers are rarely prepared for the intense scrutiny they will be subject to by buyers of experienced buyers and their litany of professional transaction advisors. Investment banks can help business owners with this preparation which can involve everything from preparing detailed financial models and projections to in-depth customer analyses to working with management to prepare them for an intense transaction process.

Educating and coaching the owner

The vast majority of business owners have never closed a transaction. Quality investment bankers have managed hundreds of transactions and can bring the benefits of that experience to the owner.

Structuring the transaction

Transactions can involve various forms of consideration, such as cash, equity, seller notes, earnouts and other forms of contingent consideration. Investment bankers can structure each transaction specifically to address the needs and desires of both sellers and buyers, thus providing creative solutions for potentially conflicting transaction objectives.

Enabling owners to run the business

The transaction process is an intensive process for sellers to endure, especially as they are trying to run the day- to-day operations of their company. By taking on most of the day-to-day work, investment banks enable business owners to focus on growing their business rather than managing the transaction process, which typically lasts for between six and nine months.

Key Findings

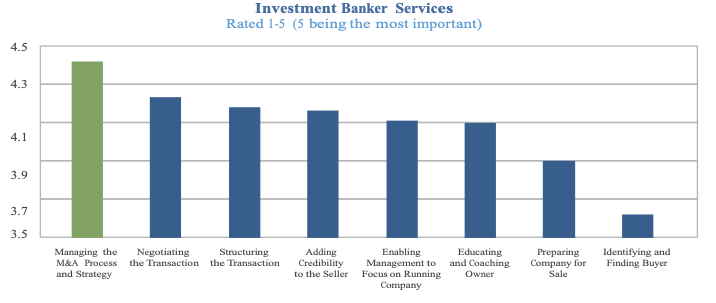

1. Of the services provided, which ones did business owners value the most?

Successful sellers responded that all of the services provided by investment bankers were highly valued, as all were rated higher than a 3.5 on a scale of 1-5. The more detailed results are presented below:

Managing the complex M&A process and strategy was valued the most by owners. By maintaining a competitive process with multiple bidders, investment bankers can maximize shareholder value through a disciplined process. Without a disciplined, competitive process, sellers may question if the best possible offer was obtained.

Negotiating and structuring the transaction were ranked next on the list of highly valued services. By allowing the investment banker to lead the negotiations, sellers can maintain a positive working relationship with their new owner. If sellers take on these difficult negotiations themselves, the relationship between buyer and seller can often start off on the wrong foot.

Investment bankers can insulate sellers from these difficult negotiations to help obtain the best possible outcome that meets their client’s transaction objectives.

Similarly, the creativity and experience of investment bankers in structuring a transaction can drive incremental value and achieve all of the various objectives of both buyer and seller. With good structure, buyers can limit their potential risks while sellers can often get preferential tax treatment or gain significant upside beyond the consideration paid at closing. Negotiating and structuring a transaction solution that balances the objectives of both buyer and seller can also increase the probability of a successful close.

The first two questions that most business owners ask in their interviews of potential investment bankers are:

- Can you find me a buyer?

- How many deals have you done in XYZ industry?

Surprisingly, despite its perceived importance by many sellers at the outset, “identifying or finding the buyer” was ultimately valued the least by successful sellers.

Investment bankers can tap into not only their professional contacts and networks but also a wide variety of industry research, sophisticated investor databases and internet searches to identify additional potential buyers. The marginal value of identifying a potential buyer often pales in comparison to the other services investment bankers provide.

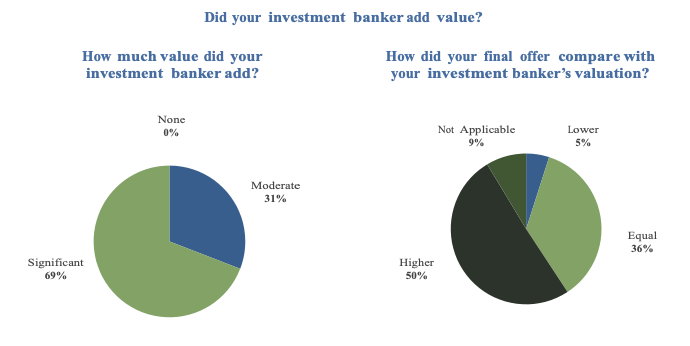

2. Do business owners believe that their investment bankers add value?

It's worth noting, 100 percent of survey respondents said that their investment bank added value to the transaction process and contributed to a successful closing.

According to these sellers, investment bankers add moderate or significant value by “leveling the playing field” between professional buyers (and their world class advisors) and the first-time seller.

These results will not be a surprise to experienced transaction professionals, but may be to owners of privately held companies. Large corporations and private equity firms almost always hire investment bankers when selling their portfolio companies because of the value the investment banker delivers. (Download the whitepaper here.)