Numbers are black and white, right? Not really. When you hire an investment banker to sell your business, they "normalize" the company's numbers to present the best version of your financial performance. What do they look for, and what can you do in advance to help the sales process? In this article, we identify the top 10 EBITDA adjustments so you can have a better chance at selling your company at the highest price.

Read: Back to Basics: How to Calculate EBITDA

Why Normalize EBITDA?

EBITDA is usually taken as a proxy for operating cash flow. While EBITDA can be interpreted in different ways, it is often used to value companies by applying a multiple (such as 5x TTM EBITDA). Therefore, because EBITDA can drive the valuation of a company, normalizing it to present the best financial representation just makes sense. A smart buyer will look beyond EBITDA and focus on free cash flow to value a business (which would consider capital expenditures, interest, taxes, etc.). However, the calculation usually starts with EBITDA and proceeds from there, so knowing how to normalize EBITDA and present as high a number as possible is a very valuable skill for company owners to have.

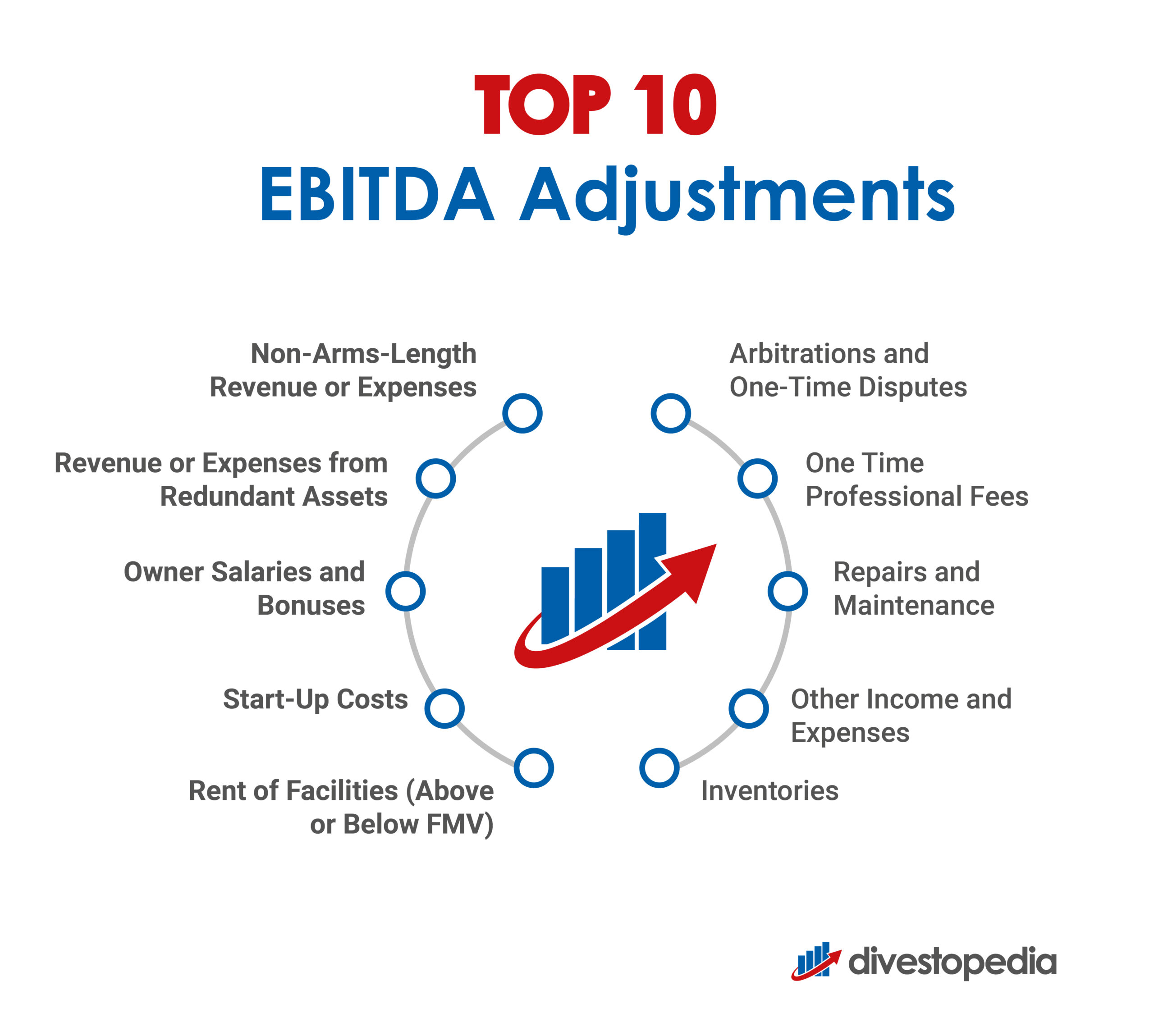

Top 10 EBITDA Adjustments

So how exactly can you normalize EBITDA? Here are 10 of the best normalizing adjustments (in no particular order). Remember that it's important to do these calculations before you put your business up for sale. At the very least, it should save you money when you hire an investment banker to market your company.

- Non-Arms-Length Revenue or Expenses

This refers to a company that enters into transactions with related parties at a price that is lower or higher than market rates. An example would be if your operating company buys supplies from another company owned by a major shareholder at prices higher than market value. When your operating company goes up for sale, you would normalize EBITDA to reflect the fair market value of these supplies.

- Revenue or Expenses Generated by Redundant Assets

Redundant assets are not used to run the business. Imagine that your business owns a lake cottage that is occasionally used for company functions or as an incentive for good performance among your employees. The cottage isn't really needed to run the business— it would be redundant to a buyer. Therefore, if the expenses related to this cottage have been paid for by the company, these expenses would be added back to normalize EBITDA.

- Owner Salaries and Bonuses

Owner salaries are often higher or lower than the regular salary that would be paid to a third-party manager. Also, when owners manage the business, a bonus may be declared at the end of the year to reduce income taxes. This bonus and any extraordinary owner salaries need to be added back to calculate recurring EBITDA. An estimate of the third-party manager compensation would be deducted. The typical result, particularly if large year-end owner bonuses have been paid, is an increase in EBITDA.

- Rent of Facilities at Prices Above or Below Fair Market Value

Many companies do not own the facilities they occupy, but instead rent them from a holding company owned by a shareholder. This is similar to related party transactions that need to be adjusted, but I single it out as a separate point given how frequently it occurs. The rent is often arbitrarily set above the going market rent. EBITDA would be adjusted upwards by adding back the arbitrary, non-arms-length rent and subtracting the true market rent.

- Start-Up Costs

If a new business line has been launched during the period when the historical results are being analyzed, the associated start-up costs should be added back to EBITDA. This is because the costs are sunk and will not be incurred going forward.

- Lawsuits, Arbitrations, Insurance Claim Recoveries and One-Time Disputes

Any extraordinary income or expenses that may have been settled during the review period would not recur. Therefore, they would be deducted (in the case of income such as an insurance claim recovery) or added back (in the case of an expense such as a lawsuit settlement).

- One Time Professional Fees

Look out for expenses incurred that relate to matters that do not recur in the future. An example is legal fees a business may incur in settling a legal dispute. Not only would you add the settlement expense back to EBITDA, but you would also add back the related legal expenses. The same applies for accounting fees on special transactions or marketing costs if you did a one-time marketing campaign.

- Repairs and Maintenance

One of the most overlooked categories to review is repairs and maintenance. Often, private business owners will aggressively categorize capital expenses as repairs in order to minimize taxes. While this practice may reduce annual taxes, it will hurt the valuation when the business is sold by reducing historical EBITDA. Therefore, an adequate review to separate and add any of these capital items back to EBITDA is a must.

- Inventories

If your company provides services using equipment, there is usually parts inventory on hand. Often, private business owners will carry a general allowance of parts inventory throughout the year (say $25,000 for a small warehouse). Like capital purchases, parts acquired during the year are also expensed to minimize income for tax purposes. If there is more inventory than the general allowance being carried, it would be smart to count and value this inventory as close to the time the business is sold as possible. Any excess over the carried allowance of $25,000 would be added back to EBITDA in order to account for the actual inventory value carried.

- Other Income and Expenses

This financial statement category is usually loaded with items that may be added back to EBITDA. It is also sometimes the dumping ground for expenses that cannot be coded elsewhere. Pay careful attention to these accounts, and make sure that anything that is not recurring gets added back. For example, some companies record one-time employee bonuses or special donation expenses in this category. These should definitely be added back to EBITDA.

Numbers are not black and white, especially if you are calculating EBITDA to sell your business. Investment bankers will prepare a five-year summary of normalized EBITDA to market your company. There is nothing holding you back from reviewing your own numbers well before you decide to sell to ensure that you get the best deal when you do. Ultimately, 5x a higher EBITDA is always better.